China and the US are escalating their trade conflict by imposing fees on each other’s ships, alarming investors. President Trump posted, “Don’t worry about China, it will all be fine!” yet tensions continue to rise.

European markets opened lower on Tuesday despite Wall Street’s gains the previous day, when Trump reassured investors about US-China relations.

Investor confidence remains fragile as the world’s two largest economies confront each other over trade dominance.

Both countries began charging fees on each other’s vessels on Tuesday. Washington set a $50-per-tonne (€43.27) levy on Chinese ships in US ports. Beijing responded with a 400-yuan (€48.65) per-tonne charge, which will gradually increase.

China also sanctioned five US-linked subsidiaries of South Korea’s Hanwha Ocean to strengthen its maritime position.

Trade negotiations between Beijing and Washington remain uncertain, though Trump said he may still meet President Xi Jinping later this month at a regional summit.

Over the weekend, Trump threatened 100% tariffs on Chinese goods before softening his tone online, calling Xi “highly respected” and claiming both nations want to avoid economic collapse.

European investors also remain cautious as France’s new Prime Minister, Sébastien Lecornu, prepares to address parliament at 15:00 CEST to present a budget aimed at cutting the nation’s large deficit.

In the UK, unemployment rose to 4.8% in the three months to August, intensifying fears about the country’s economic outlook.

European Stocks Slip as Trade Tensions Mount

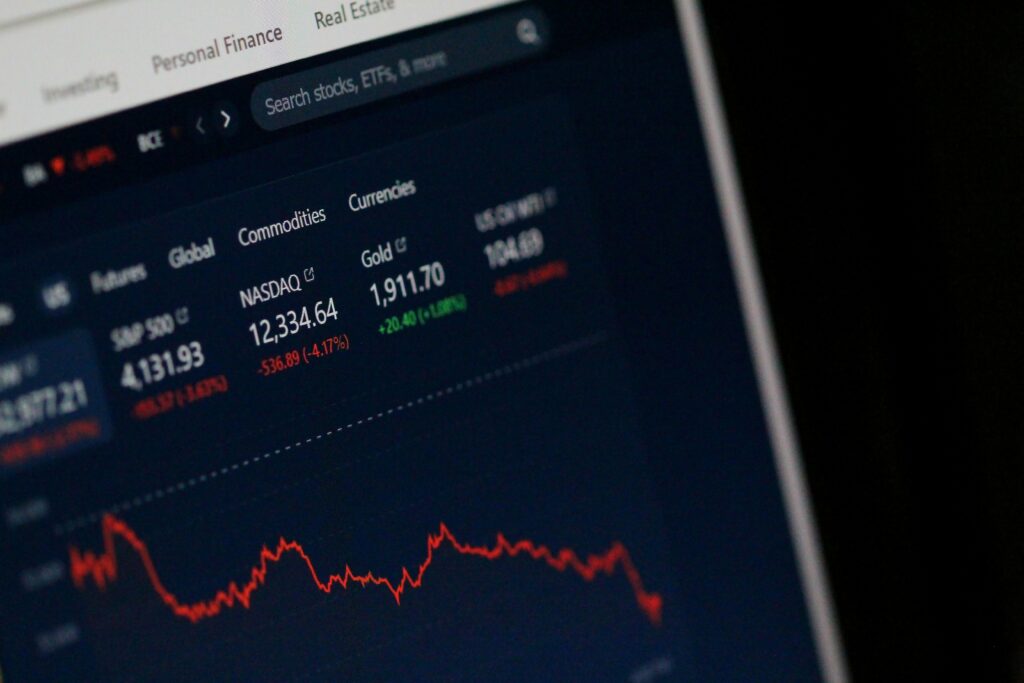

By midday in Europe, major stock indexes were sliding. London’s FTSE 100 dropped 0.38% to 9,406.64, Paris’s CAC 40 declined 0.76% to 7,874.20, and Frankfurt’s DAX lost 0.87% to 24,176.42.

The STOXX 600 benchmark fell 0.71%, and Madrid’s IBEX 35 slipped 0.2% to 15,511.00.

In corporate news, EasyJet shares surged nearly 5% after reports of a possible takeover by shipping giant MSC. MSC denied the claims, yet the airline’s stock stayed elevated.

“Investors are speculating about who might buy EasyJet. That’s why the stock remains high despite MSC’s denial,” said Dan Coatsworth, head of markets at AJ Bell.

Across the Atlantic, futures also weakened. Dow Jones futures fell 0.8%, S&P 500 futures dropped 0.94%, and Nasdaq futures slid 1.23%.

Meanwhile, rare earth companies in the US rallied as trade tensions with China intensified. Critical Metals jumped over 33% in premarket trading, USA Rare Earth climbed 9%, and MP Materials gained 6%.

The euro and the British pound both weakened against the dollar, while the Japanese yen strengthened slightly.

Oil prices also declined. US benchmark crude sank over 2% to $58.25, and Brent crude slipped under $62, losing about 2%.

Gold and silver surged as investors sought safe havens. Gold rose 0.58% to $4,156.80, while silver briefly hit a record above $52 before easing to $50.

Cryptocurrencies continued to fall sharply. Before noon in Europe, Bitcoin dropped 3.5% to $111,801, and Ethereum slid 6.4% to $4,006.49.

Markets Brace for Earnings Amid Bubble Fears

Global investors are bracing for major corporate earnings reports as fears of an AI-driven market bubble grow.

Critics argue that US tech valuations have soared too far ahead of profits, echoing warnings from the 2000 dot-com crash.

Concerns about inflated prices now heighten the importance of this week’s earnings releases from key firms including JPMorgan Chase, Johnson & Johnson, and United Airlines.